The TV sports “game”

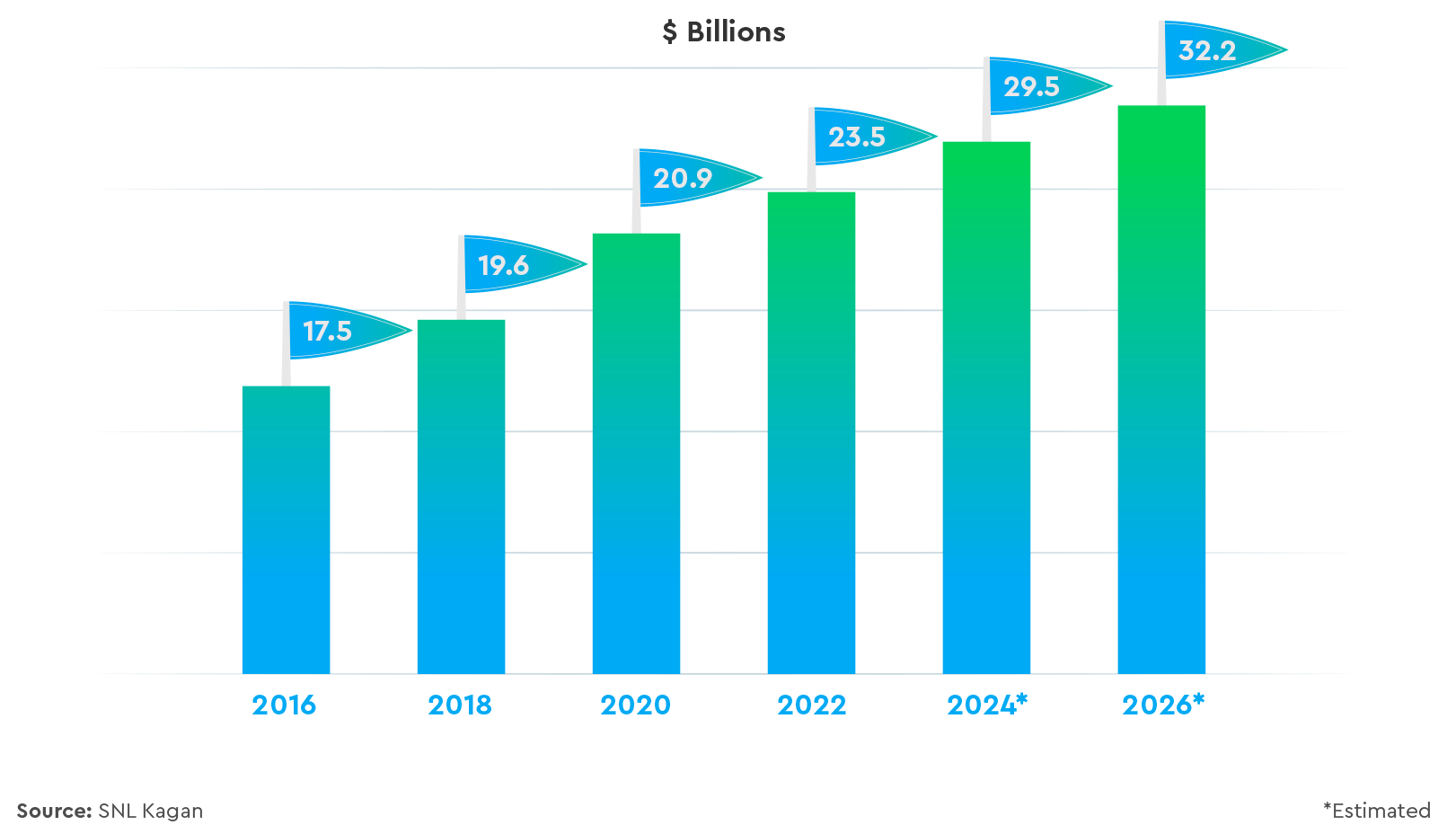

Sports broadcast revenue climbs

Media rights fees paid in the US to broadcast sporting events

As a country, we love sports, especially regional sports and live sports, which are considered must-have TV programming. Unfortunately, fees for this type of programming is expensive and the costs keep rising, and TV networks know they can pass those costs back to cable companies like us and ultimately to you, our customers.

When we don’t agree to the fee increases, the TV networks won’t give us access to air your favorite sports. We don’t think that’s fair, and we hope you agree that negotiating to keep your costs at a reasonable price is worth the effort.

Regional Sports Networks

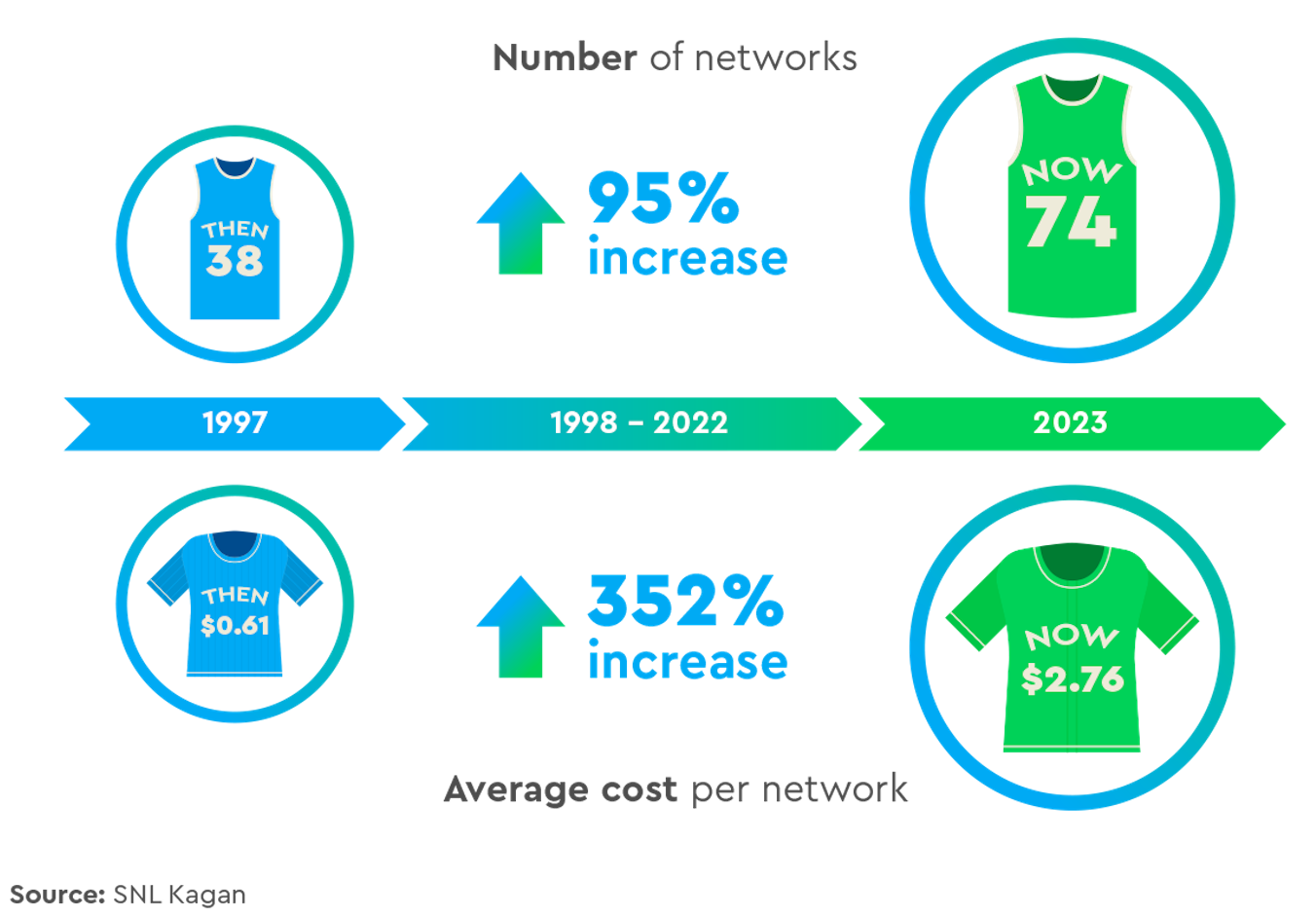

Regional sports networks, or RSNs, are among the most expensive channels on your lineup. Originally RSNs carried all the regional, professional and collegiate teams on one channel, with one fee. Today, sports programmers spin off teams to their own separate channels, each with their own fee, so that they can get more money for the same games.

RSNs also require all TV providers to offer their Networks on the most basic packages to reach the most homes. This way, they can charge everyone for their Networks – even those that don’t want it.

The explosion of sports

networks drives up TV costs

1997-2023

Growth in number of sports networks and

cost per network impacts your bill every month

What do others say?

Hoping to watch FSN and YES on Hulu or YouTube TV? The future looks bleak

In early fall, both YouTube TV and Hulu dropped the Sinclair-owned regional sports networks — including Fox Sports North — from the list of channels it offers. It was the latest blow for cord-cutting sports fans who had subscribed to those services or previously had Sling TV and/or Fubo, which dropped the RSNs more than a year ago.

Report: Sports Programming Costs Average $18.55 Per User or 22.1% of ARPU

Kagan’s research suggests that the fees pay-TV providers charge customers for sports networks are less than programming costs for those networks. According to the researchers, the average cost per subscriber for sports networks was $13.30 in 2018 – which is less than the average sports programming cost of $18.55 per subscriber.

Why Can’t Reds Fans Watch FSO On Hulu, YouTube Or Other Streaming Services?

Sinclair, which bought FSO, YES and 20 other Fox RSNs in 2019, has been unable to restore the sports channels to Hulu + Live TV and YouTube TV. Sling TV and Dish Network dropped the Fox RSNs in July 2019. Fox RSNs disappeared from fuboTV in January 2020.

#GameOver: Regional Sports Networks: NBA, MLB and NHL Need New Media Strategy

An RSN owner finally admitted publicly what we already knew: the ONLY viable RSN economic model is to force everyone who takes multichannel television to pay an exorbitant price/sub/month to subsidize the TINY minority of fans that want to watch the channel; essentially forcing subscribers to subsidize how much the RSNs have overpaid the teams for media rights.

YouTube TV-Sinclair fight proves regional sports need a la carte model: analyst

Greenfield said the current RSN economic model – which essentially forces pay TV subscribers to subsidize the cost of the channels, even if they don’t watch them – does not work anymore for distributors.

Sports now account for 40% of pay-TV programming cost, SNL Kagan says

Sports programming now costs pay-TV consumers an average of $18.37 a month and accounts for 40% of programming costs for cable, satellite and telco video providers, according to SNL Kagan stats published by the Los Angeles Times Monday. newfound bounty, those with cable and satellite subscriptions bore the brunt of the cost.